Change default status

Introduction

On a daily basis, the Akkuro platform reviews all loans and status of payments. Automatically, it will set a loan to 'in default' if any due payments have been unpaid (taking into account the tolerance period). When a loan is 'in default', certain actions, such as change interest, will be disabled on the loan.

Once a loan is 'in default', it is possible to change the status of the loan to a more specific ‘in default’ status to identify in which stage of the collections process the loan is in (e.g., lawyer collection, external collection). This status update will be reflected on the loan details.

Change in default status

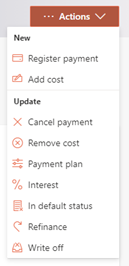

From the Customer Data Model overview page, by clicking on the ‘Actions’ button in the top right corner and selecting ‘In default' status, you can change the default status of an existing loan. If the loan is not 'in default', then this menu item will not be available.

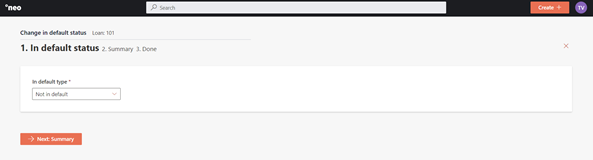

Once you select that, you will have the possibility to select another predefined default type. This 'in default' type is just a tag for reporting or book-keeping purposes & does not affect the functionality of the loan.

After selecting the default type, you will have to review the updated status on a summary page, then confirm the change.

Depending on the configuration of the ‘Change In Default Status’ process in the Configuration Portal, once the changes are confirmed, they will either be implemented immediately, or an approval task will be created where a second user needs to confirm the changes. More information on the approval tasks can be found under Task management.

The default status of the loan has now been changed and will be visible on the Loan 360° page under ‘Highlights’>’Default status’.

Updated 10 days ago