Loan disbursement

Introduction

With the Akkuro payment gateway, you are able to automatically disburse loans and limit the amount of manual payment processing required during the loan creation process.

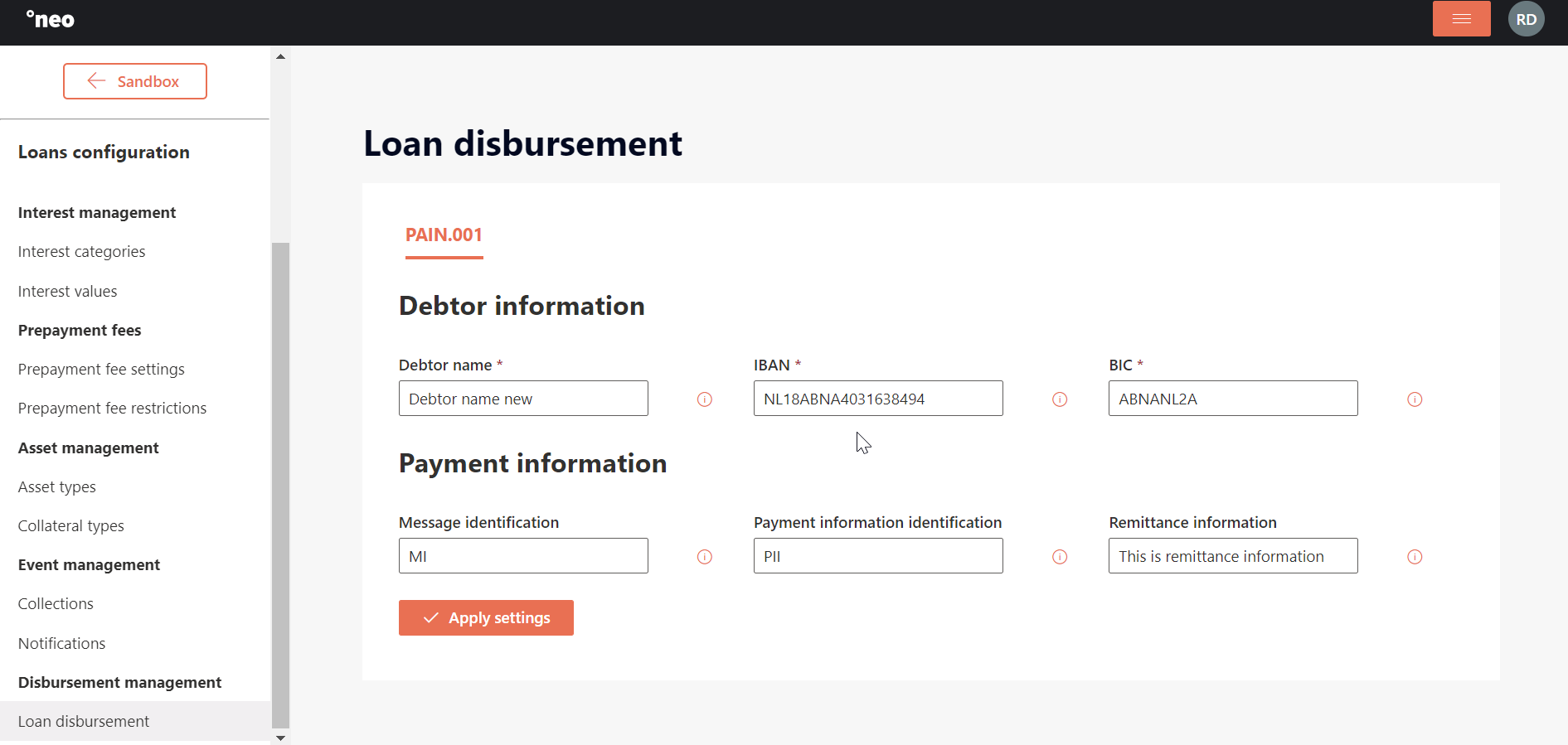

Loan disbursement

Disbursements of loans will require configuration of several settings before a payment file can be created. Currently, PAIN.001 is supported as a resulting payment file type for the loan disbursement.

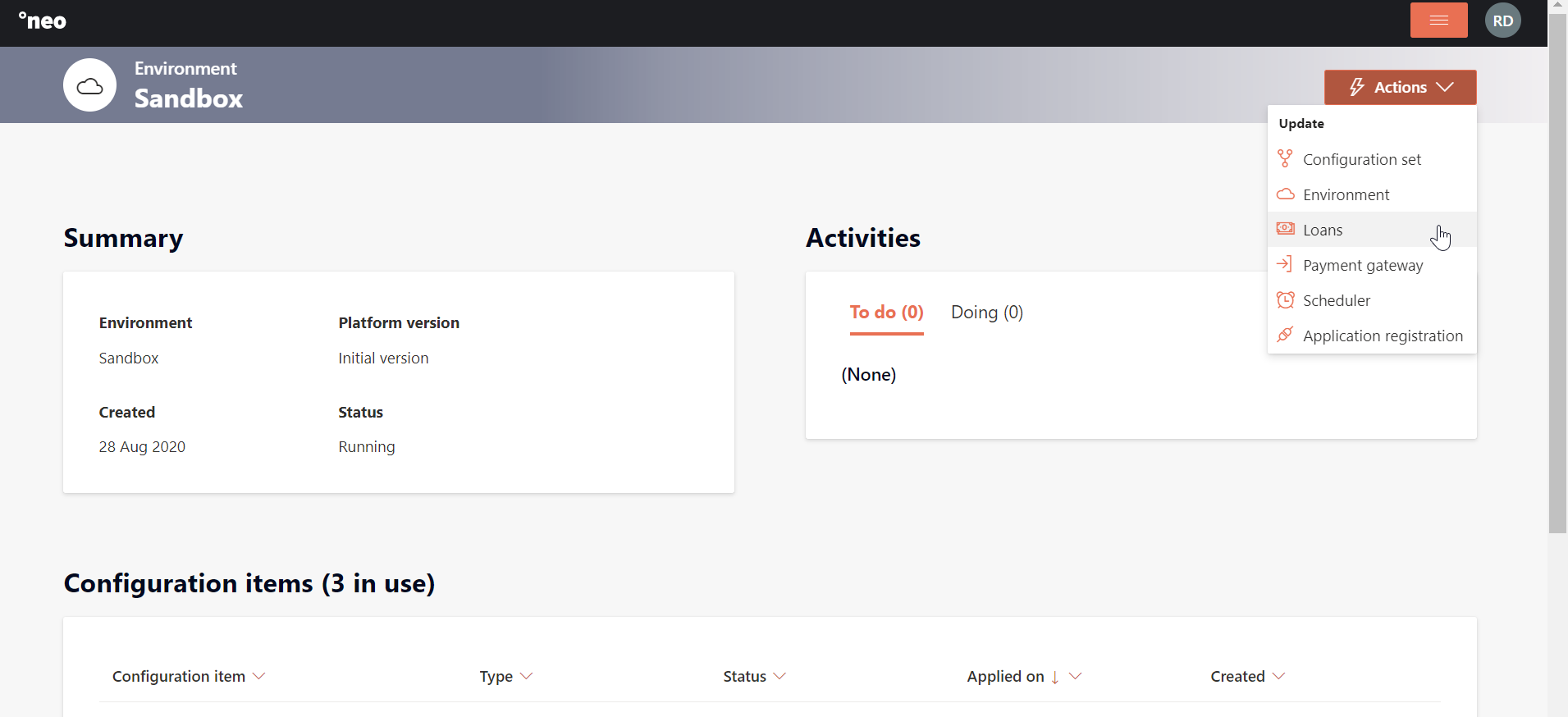

The loan disbursement is configured under loans, on the environment level in the Configuration Portal.

Debtor information

The debtor information is mandatory. This information will always be the same for every payment.

| Item | Restriction | Description |

|---|---|---|

| Debtor name | 70 characters | This is the name of your business. Your creditor will see this name as the originator of the payment. |

| IBAN | 34 characters | This is your IBAN, from where you want to pay your creditor. |

| BIC | BIC8 or BIC11 | This is your Bank Identifier Code that goes in combination with your IBAN. |

Payment information

The payment information is not mandatory. Information will be provided by Akkuro, you can optionally add your own information.

| Item | Restriction | Description |

|---|---|---|

| Message identification | 17 characters | This is unique message identification. The first 18 characters are always the conversion of the date and time to ticks. The next 17 characters are free format. |

| Payment information identification | 17 characters | This is unique payment information identification. The first 18 characters are always the conversion of the date and time to ticks. The next 17 characters are free format. |

| Remittance information | 140 characters | This is the remittance information that will be visible on the transaction. Wildcards can be used to dynamically fill information based on the transaction information itself. If the use of wildcards exceeds the maximum of 140 characters, the remittance information will be cut off after 140 characters. |

Remittance Information Wildcards

In the remittance information you can use wildcards to personalize the information that is visible to your creditor. Wildcards are a predefined set of codes that must be used exactly as specified in order for them to work.

For instance, your creditor's name is Five Degrees. The creditor name has wildcard creditor.name. In order for the remittance information to replace the wildcard by the actual creditor name, you have to use the wildcard exactly as (creditor.name). When the remittance information is created, it will replace the wildcard with the creditor name for the disbursement.

The following wildcards are available.

| Item | Wildcard | Description |

|---|---|---|

| Creditor name | (creditor.name) | This is the name of your creditor that is registered on the nominated account of the loan. |

| Creditor IBAN | (creditor.iban) | This is the IBAN of your creditor that is registered on the nominated account of the loan. |

| Creditor BIC | (creditor.bic) | This is the BIC of your creditor that is registered on the nominated account of the loan. |

| Loan identifier | (loan.id) | This is the unique loan identifier. |

| Loan amount | (loan.amount) | This is the total amount of the loan. |

Allowed character set

The allowed character set for any of the fields on the loan disbursement page are as follows:

a b c d e f g h i j k l m n o p q r s t u v w x y z

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

/ - ? : ( ) . , ' +

0 1 2 3 4 5 6 7 8 9

Space

Updated 10 days ago