Loan template

Introduction

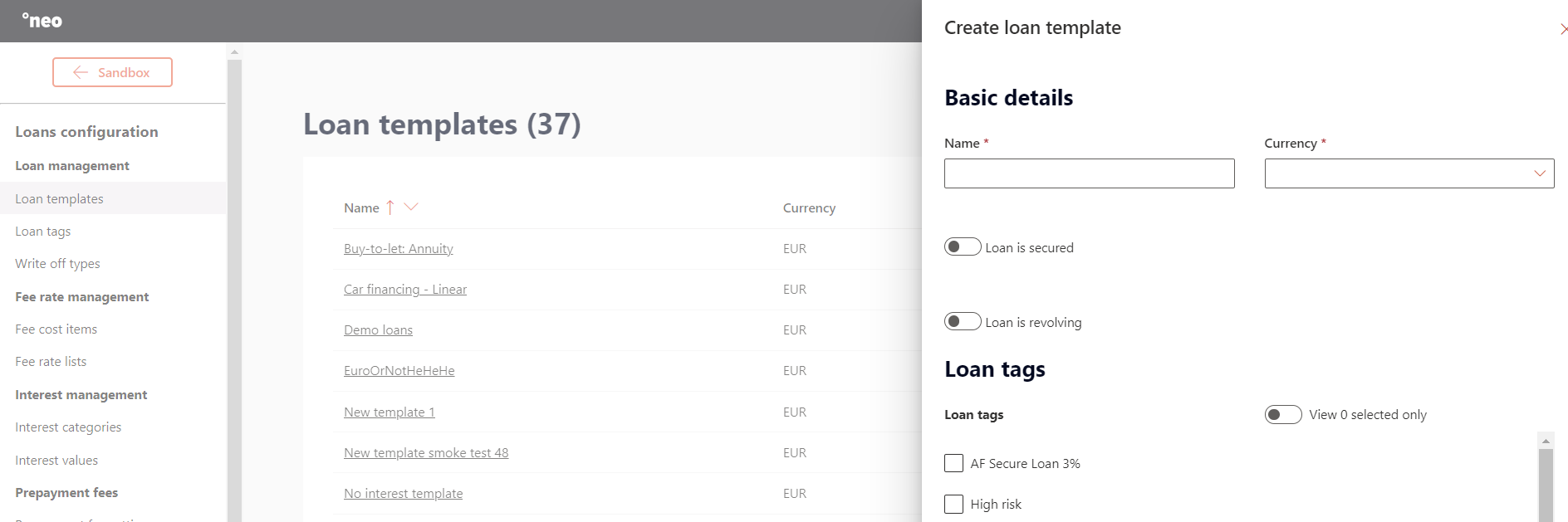

On the configuration portal you will be able to create new product templates. On the template you will define a set of characteristics which we be applied on the loan when created with this template.

Loan templates

Creating a new template: ‘Loan templates’ > ‘Create loan template’

| Item | Description |

|---|---|

| Name | The name of the loan template, this name will be shown when selecting a template in the client service portal when creating a loan. |

| Currency | The currency of the template. |

| Slider-Loan is revolving | Ability to set if it will be a secured loan. When a revolving loan is selected, setting the revolving type is mandatory. |

| Revolving type | 1. A loan with a 'revolving' revolving type is one where a borrower can do drawdowns until they reach the set limit of the loan, and as they repay their outstanding balance, it will become available for they to drawdown again. 2. A loan with a 'term' revolving type means as the client repays their outstanding balance, it will not be added back to their available limit. |

| Slider – Loan is secured | Ability to set if it will be a secured loan. When creating a loan using a secured template, when it’s a secured loan an asset needs to be set on the loan. |

| Holiday calendar | Ability to set pre-created holiday calendar (non-business day calendar). |

| Date roll type | Ability to set what needs to happen when a calculated repayment date is a non-business day and needs to be changed to a business day, the following options are supported: 1. Next business day after, the next business day after the repayment date will be taken. 2. Last day of the month or first business day of next month, last business date of the month after repayment date will be taken or first business day of next month. 3. Next business day after modified, the next business day, unless it goes over to the next month, then it's Last business day before. 4. Nearest business day in time, the closest business date, before or after the repayment date, will be taken. 5. No rolling, non-business days will not be taken into account. 6. Last business day before, the last business day before the repayment date will be taken. |

| Fee rate list | Ability to set pre-created fee rate list of the rate list type general, fees other than repayment fees. |

| Payment fee rate list | Ability to set pre-created fee rate list of the rate list type payments, automatic applied fees for repayments. |

| Prepayment fee setting | Ability to set pre-created prepayment fee settings. |

| Prepayment fee restriction | Ability to set pre-created prepayment restriction, which can limit the fee charged on an extra repayment. |

| Tolerance period days | Ability to set a number of business days, in these days the loan will not go into default when a repayment isn’t done on the day it was expected. |

| Tolerance period Date roll type | The date roll type related to the tolerance period, when a tolerance period consists of non-business days: 1. Last day of the month or first business day of next month, last business date of the month after non-business date will be taken or first business day of next month. 2. Next business day after, the next business day after the non-business date will be taken. 3. Next business day after modified, the next business day, unless it goes over to the next month, then it's Last business day before. 4. Nearest business day in time, the closest business date, before or after the non-business date, will be taken. 5. No rolling, non-business days will not be taken into account. 6. Last business day before, the last business day before the non-business date will be taken. |

| Principal payment type | 1. Annuity, equal installments for the duration of the loan as the interest decreases and the principal increases over the installments. The rounding is distributed on all repayments. 2. Equal principal (Linear), the principal payment will stay the same during the lifetime of the loan, but the interest part will be lower in the last repayments, so first installments will be higher because of the higher total principal amount of the loan. 3. Fixed equal payments, equal installments for the duration of the loan as the interest decreases and the principal increases over the installments, all rounding is distributed to the last repayment. |

| Default extra payment type | Ability to define how the amount, which is paid extra, will be processed on the loan. The following options are supported: 1. DecreasePrincipal: the payment will decrease the next principal repayment amounts of the loan equally, and the interest will also change accordingly. The decrease is divided across all principal payments (total payment is divided across all remaining cashflows). If accrued interest is applicable on the day you perform this extra payment, this will be paid first. 2. PrincipalOnly: the payment will decrease the next principal repayment amounts of the loan equally, and the interest will also change accordingly. The decrease is divided across all principal payments (total payment is divided across all remaining cashflows). If accrued interest is applicable on the day you perform this extra payment, this will not be paid. 3. LastActualPayment: The extra payment will pay off the principal amounts of the last repayments of the repayment plan (i.e. the final cashflow). Accordingly the interest related to the repaid principals will also become zero. Any fee item will be marked as cancelled and not paid. In case of a pre-computed loan, the fee should be paid. 4. NextActualPayment: The extra payment will pay off the principal amounts of the first (next) repayments of the repayment plan. Accordingly the interest related to the repaid principals will also become zero. The interest, which isn't paid, will become part of the first to be paid repayment. 5. NextExpectedPayment: The extra payment will pay of the first (next) installment(s) (principal + interest) of the repayment plan. Any fee item will be marked as cancelled and not paid. In case of a pre-computed loan, the fee should be paid. |

| Penalty calculation type | Ability to set a specify penalty interest percentage (of the installment) when a repayment is not done on time. The repayment amount will increase when penalty is applied: 1. No Penalty. 2. Fixed penalty rate. 3. Floating penalty rate, you will need to select pre-created penalty category, which can be created under interest management, interest category type: penalty rate. 4. Proportion of interest with spread, ability to set the penalty interest which is a percentage over the total interest percentage (base+spread). Example when base interest is 5% and spread is 1%, proportion of interest is set to 200% (penaltyInterestPercentage) the penalty interest on the installment will be 12%. 5. Spread on interest, ability to set the penalty interest which is based on the base and spread interest rate. Example when base interest is 5% and spread is 1%, spread on interest is set to 1% (penaltyInterestPercentage) the penalty interest on the installment will be 7%. 6. Spread on fixed spread, ability to set the penalty interest which is based on the spread interest rate. Example when base interest is 5% and spread is 1%, spread on fixed spread interest is set to 1% (penaltyInterestPercentage) the penalty interest on the installment will be 2%. |

| Notification process | Ability to set a pre-created notification process, event, when X days before a repayment is expected |

| Slider – No interest | Ability to set if interest needs to be paid for the loan. |

| Slider – Prepaid interest | Ability to set that the interest is paid at the beginning of the period, standard at the end of a period |

| Interest type | Two types of interest are supported: 1. Fixed interest 2. Floating interest, a pre-created interest category needs to be selected. When setting floating interest, you will need to define if the interest is weighted average over a period or takes the interest rate at the start of a period. |

| Day count type | The following day count types regarding the interest calculation are available: 1. Actual/Actual AFB, uses the actual number of days between two periods and divides the result by the number of days in the year for the interest per day, following the AFB principles. 2. ACT/ACT ISDA, Actual/Actual ISDA, following the ISDA principles. 3. ACT/ACT ISMA, Actual/Actual ISMA, following the ISMA principles. 4. Actual/360, calculates the interest daily by counting the number of days in the calendar, but uses a fixed 360 year length. 5. ACT/365, Actual/365, calculates the interest daily by counting the number of days in the calendar and uses a fixed 365 year length. 6. 30/360, counts the days from the calendar, introduces differences for the months with 31 and 28 days, US style. 7. 30E/360, counts the months always as 30 days, Europe style. 8. 365/360, fixed 365 days in calendar, but with fixed 360 days in a year. 9. 365/365, fixed 365 days in calendar and fixed 365 days in a year. |

Updated 26 days ago