Change payment plan

Introduction

Throughout the life of a loan, it is possible to update the payment plan properties. Changes to the payment plan of the loan might include changes to the next payment dates, months between payments, or number of expected payments. These changes can be applied to the principal payments and/or the interest payments.

Change a payment plan

From the Loan 360° overview page, by clicking on the ‘Actions’ button in the top right corner and selecting ‘payment plan', you can change the payment plan properties of the loan.

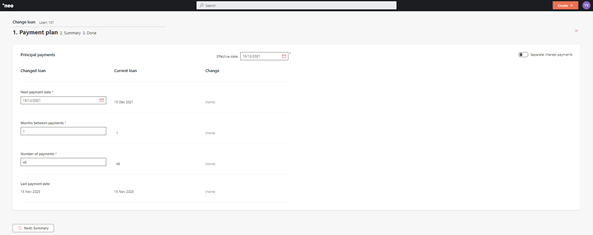

Once that is selected, you will have to fill out a few properties related to the new payment plan. The payment plan for principal and interest can be changed separately by using the slider on the screen ‘Separate interest payments’.

Note: it is not possible to change the payment plan for a loan, when loan is within the tolerance period.

Effective date

You can change the payment plan to be effective as of a date in the past or as of today. This date must be after/on the last paid payment. It is not possible to register payments changes to the payment plan for future effective dates.

Next payment date

You can select a new next payment date. This date represents the next expected payment for the loan, and all other payments will be adjusted based on this new set date.

In the case of an equal payments (annuity) method, when you select the ‘separate interest payments’ toggle and inputs separate interest payments, the next principal payment date cannot be before the next interest payment date.

Under annuity payment plans, it will not be possible for principal-only payments, but it is possible to have interest-only payments for the beginning cashflows.

Months between payments

You can enter a new number of months between payments.

Number of payments

You can enter a new number of payments.

Last payment date

You can change the last payment date of the complete outstanding cash flow.

When you select the ‘separate interest payments’ toggle and the data for the interest payment section is different than for the principal payment section of the loan, you should ensure that the last payment date is always the same.

After inputting the new payment plan of the loan, you will be able to see the summary of the changes on the right side by clicking 'Recalculate'. In addition, you will be able to see the forecasted cashflows that reflect the new payment plan by clicking 'Next: Forecast'.

Once you have reviewed the forecast you will be brought to a summary page to confirm all the change details, then confirm the change.

Depending on the configuration of the ‘Change Payment Plan’ process in the Configuration Portal, once the changes are confirmed, they will either be implemented immediately, or an approval task will be created where a second user needs to confirm the changes. More information on the approval tasks can be found under Task management.

The payment plan of the loan has now been changed and will be visible on the Loan 360° page under ‘Payment Status’.

Updated 10 days ago