Register payment holiday

Introduction

The Akkuro platform allows you to manually register payment holidays to existing loans in the system. A payment holiday is type of 'payment relief' for the borrower; it is a period of time during which a borrower does not have to make full repayments. The balance of the loan that is delayed as a result of the payment holiday will either be divided across the remaining loan duration, or added as a lumpsum on the final expected cashflow.

All payment holidays that are registered will be reflected in the payment details, expected cashflows, and history of the loan.

Note: currently this loan action is only available on precomputed interest loans.

Register payment holiday

From the Loan 360° overview page, by clicking on the ‘Actions’ button in the top right corner and selecting ‘Register payment holiday', you can register a payment holiday on the loan.

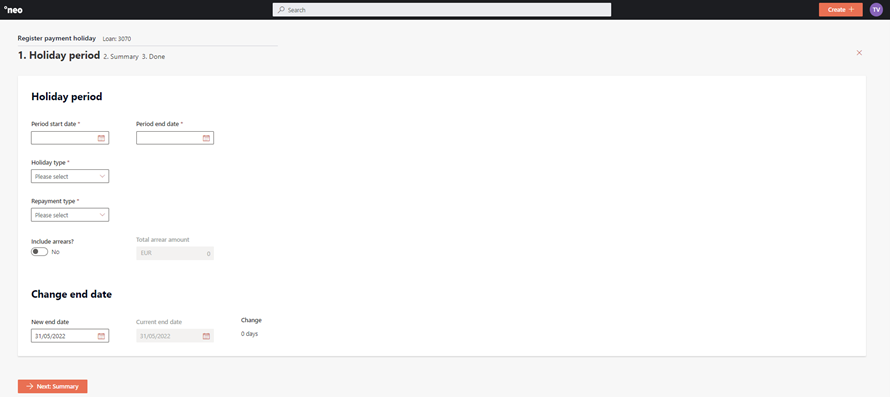

Once that is selected, you will have to fill out a few properties related to the payment holiday being registered.

Period start date

You must select the date on which the payment holiday begins. Any payment on and after this date will be delayed.

The date that can be selected can be today or in the future, but cannot be after the end date of the loan or the period end date.

Period end date

You must select the date on which the payment holiday ends. The period end date is the first date expected to resume payment. Any payment on and after this date will not be marked delayed.

The date that can be selected can be today or in the future, but cannot be on or after the end date of the loan or before the period start date.

Holiday type

You must select the type of payment holiday you want to apply to the loan. Two types of payment holiday are supported: ‘Full delay’ and ‘Fixed amount’.

A full delay payment holiday will result in the borrower not paying anything during the duration of the holiday. The total amount of the cashflow will be zero during this time.

A fixed amount payment holiday will require the borrower to pay a smaller fixed amount during the duration of the holiday. If you select the fixed amount type, you will also need to input the amount that the borrower will have to pay for each cashflow date during the payment holiday. The defined fixed amount will be the total amount of the cashflow, and will therefore be allocated across any applicable fees, penalties, interest, and principal.

Repayment type

You must select the repayment type which will define how the delayed cashflows will be redistributed across the loan. Two types of repayments are supported: ‘Rebalance’ and ‘Bullet’.

A rebalance repayment means that the total owed amount that will be delayed as a result of the payment holiday will be redistributed across all the future cashflows after the end of the payment holiday.

A bullet repayment means that the total owed amount that will be delayed as a result of the payment holiday will be added as a lumpsum to the last expected payment date of the loan.

Include arrears

Optionally, if the loan is in default, you can choose to include the arrears in the payment holiday cashflow recalculation. If enabled, all payments in arrears will be set to zero (or down to what has already been paid), and any outstanding balance will be reallocated to future cashflows depending on the repayment type selected.

Change end date

Optionally, you can also decide to prolong the end of the loan by changing the end date. The new end date will be the new final payment date.

The date that can be selected can only be in the future after the original end date of the loan.

After entering all the information, you will have to review the details on a summary page, then confirm the change.

Depending on the configuration of the ‘Register payment holiday’ process in the Configuration Portal, once the changes are confirmed, they will either be implemented immediately, or an approval task will be created where a second user needs to confirm the changes. More information on the approval tasks can be found under Task management.

The registered payment holiday will now be visible on the Loan 360° page under ‘Details’>’History’, ‘Details’>’Payments’ and captured in the cashflow details.

Note: Any cashflow that has been notified for collection with the expected payment notification is set to a read-only state, and the register payment holiday process ignore these notified payments.

Updated 5 days ago