Unsecured loan

Introduction

An unsecured loan is a loan that does not require any type of collateral such as property or other assets. Unsecured loans are only supported by the borrower’s creditworthiness.

An unsecured loan will require a number of properties to be set during the loan creation process.

| Title | Description |

|---|---|

| Principal | The principal loan amount for the loan. The principal must be a positive value above zero. |

| Issue date | The contractual start date for the loan (i.e., start date on the loan contract). The issue date is separate from the settlement (aka disbursement) date of the loan, and no interest or cashflow calculations are based on the issue date. |

| Settlement date | The expected disbursement date loan. A disbursement is the act of actually paying out the money to the borrower. All interest and cashflow calculations are based on this date. |

| Interest spread | The applicable interest spread for the loan. This spread can be greater than, less than, or equal to zero. The base rate is defined on the loan template level and spread can be applied on top of the base. Positive spreads will increase the total interest of the loan versus the base rate, and negative spreads will decrease the total interest of the loan versus the base rate. |

| First payment date | Date of the first expected repayment for the loan. This date must be equal to or greater than the settlement date since borrowers are not able to pay back their loan before it is disbursed. |

| Months between payment | The number of months between each repayment for the loan. This number must be a whole number (i.e., no decimals). |

| Number of payments | The number of repayments for the loan. This number must be greater than zero. |

Note: these loan properties also apply to secured loans and revolving credit, in addition to some extra required properties.

Creating an unsecured loan

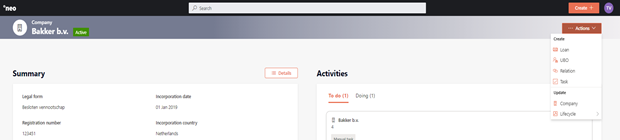

To create a new unsecured loan you can either begin the process from the Dashboard by clicking the ‘New’ button in the top right corner, or by navigating directly to the client’s profile and clicking ‘Actions’ > ‘New: Loan’.

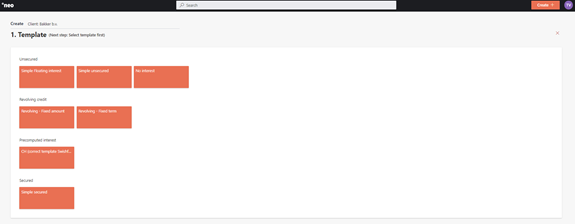

Every loan created in Akkuro is an instance of an already existing standardized loan product template, which has been created in the Configuration portal. The terms that were set for the product template will determine the new loan contract terms and conditions.

In the next screen, you will be able to see all of the product templates that are available.

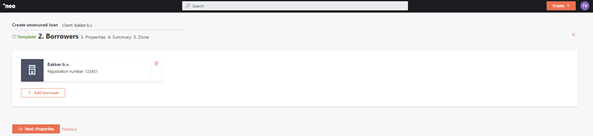

Once you select the type of loan being created (in this case an unsecured loan), you will be prompted to add extra borrowers.

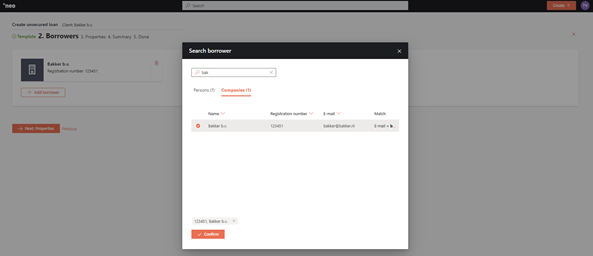

By clicking on ‘Add borrower’, you can search for persons in the system to add as extra borrowers.

Once the extra borrower is confirmed, they will be added to the loan.

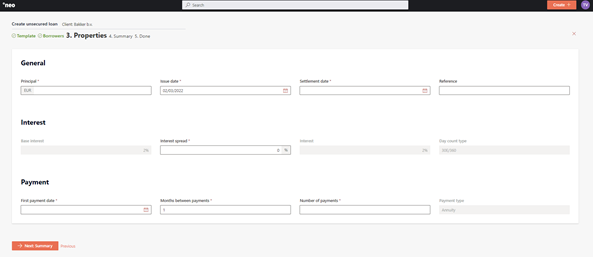

After all of the borrowers of the loan are set, you have to enter the details of the specific loan, such as principal amount, issue date, interest, payment dates, nominated account, etc..

After you have entered all the properties of the loan, you will be brought to a follow-up page where you will define the account(s) to which the loan principal will be paid out (disbursed). The disbursement can be sent to one or multiple external accounts, including the nominated account defined on the previous step.

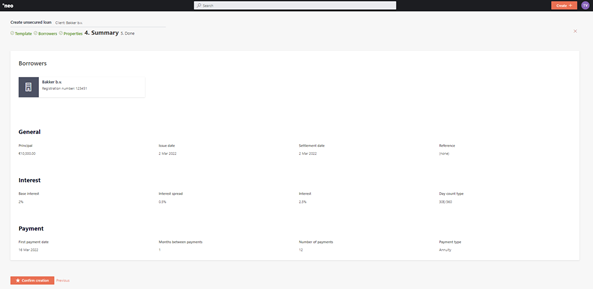

After you have entered all of information for the loan, you will be showed the forecasted cashflows of the loan and a summary page to review the borrowers and details of the loan and disbursement, and to be able to add any extra comments.

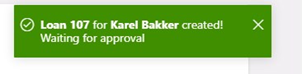

After confirmation of the summary, the loan will be created. However, depending on the set-up of the ‘Create Loan’ process in the Configuration portal, the loan will have different statuses and will either be automatically created or a task for approval will be generated.

If the loan needs to be approved, the status will be set to “Approval”, and the following message will be displayed on the loan summary screen:

If no approval is needed, the status of the loan will be set to ”Active” automatically, and no approval message is shown in the loan summary screen.

The unsecured loan is now created and will be displayed under the list of products on the borrowers’ 360° Overview.

Updated 10 days ago