Change interest

Introduction

Throughout the life of a loan, it is possible to update the interest rate properties of the loan. Changes to the interest rate scheme of the loan might include changes to the interest type (i.e., fixed vs. float) or the interest spread.

Change interest

From the Loan 360° overview page, by clicking on the ‘Actions’ button in the top right corner and selecting ‘interest', you can change interest rate properties for the loan.

Note: it is not possible to change the interest for a loan when the loan is within the tolerance period.

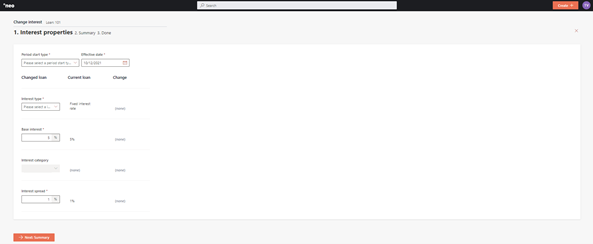

Once that is selected, you will have to fill out a few properties related to the new interest rate properties, as described below.

Period start type

You can select whether the new interest applies to the current period or should applied to the next interest period.

For example, if the monthly interest period starts on the first of the month, and it is now the 15th of month (effective date), if you select “active from last period", the new interest rate will be applied from the first of this month retroactively, or if you select "active from next period", the new interest rate will be applied from the first of the next month.

Effective date

You can change the interest to be applied as of a date in the past or for today. This date must be after the last paid payment or if there have not been any payments yet it must be on/after the settlement date.

Interest type

You can change the interest rate type from a fixed interest rate to a floating interest rate or vice versa.

When floating is selected, you must select the interest category from a predefined list of and the base interest field will be disabled. This list of base interest rates can be created and maintained in the Configuration Portal. When a fixed interest rate is selected the interest category field will be disabled and a base interest can be entered.

Base interest

You can enter a new base interest rate as a percentage.

Interest category

You can enter a new interest category.

Interest spread

You can enter a new interest spread as a percentage.

After inputting the new interest rate properties of the loan, you will be able to see the summary of the changes on the right side by clicking 'Recalculate'. In addition, you will be able to see the forecasted cashflows that reflect the new interest amount by clicking 'Next: Forecast'.

Once you have reviewed the forecast you will be brought to a summary page to confirm all the change details, then confirm the change.

Depending on the configuration of the ‘Change Interest’ process in the Configuration Portal, once the changes are confirmed, they will either be implemented immediately, or an approval task will be created where a second user needs to confirm the changes. More information on the approval tasks can be found under Task management.

The interest rate properties of the loan has now been changed and will be visible on the Loan 360° page under ‘Highlights’.

Updated 10 days ago