Loan 360° overview

Introduction

In the Client Service Portal, you can view and edit loan details anytime you need. When you open a loan, for instance from a Search result list or from a person’s/company's profile, a Loan 360° overview page is opened.

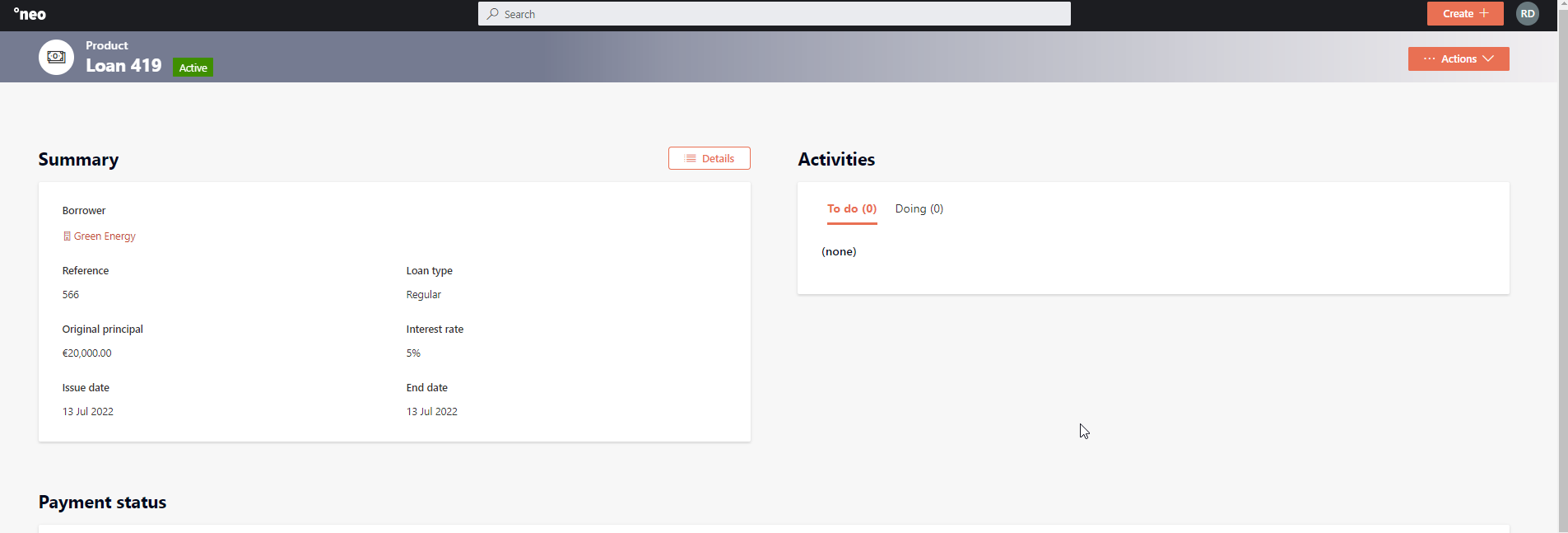

The Loan 360° gives you an overview of all the properties, payment status, cashflows, and other applicable details of the loan.

Each of these sections are described in further detail below

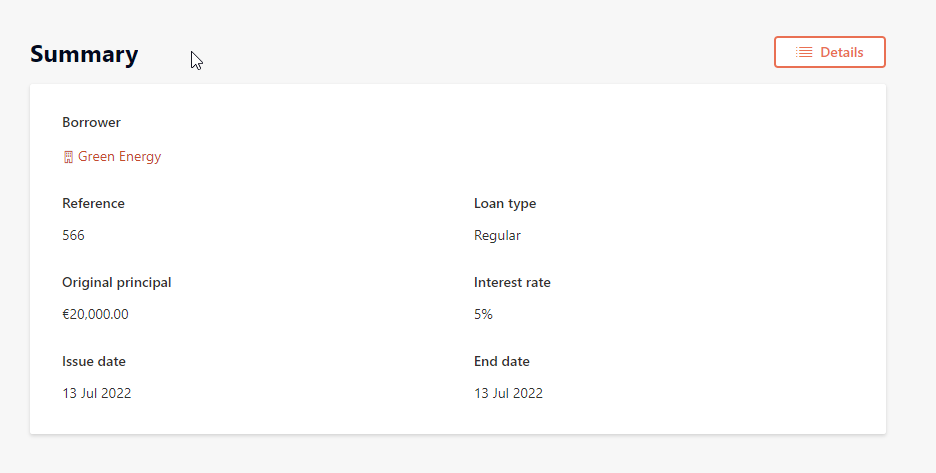

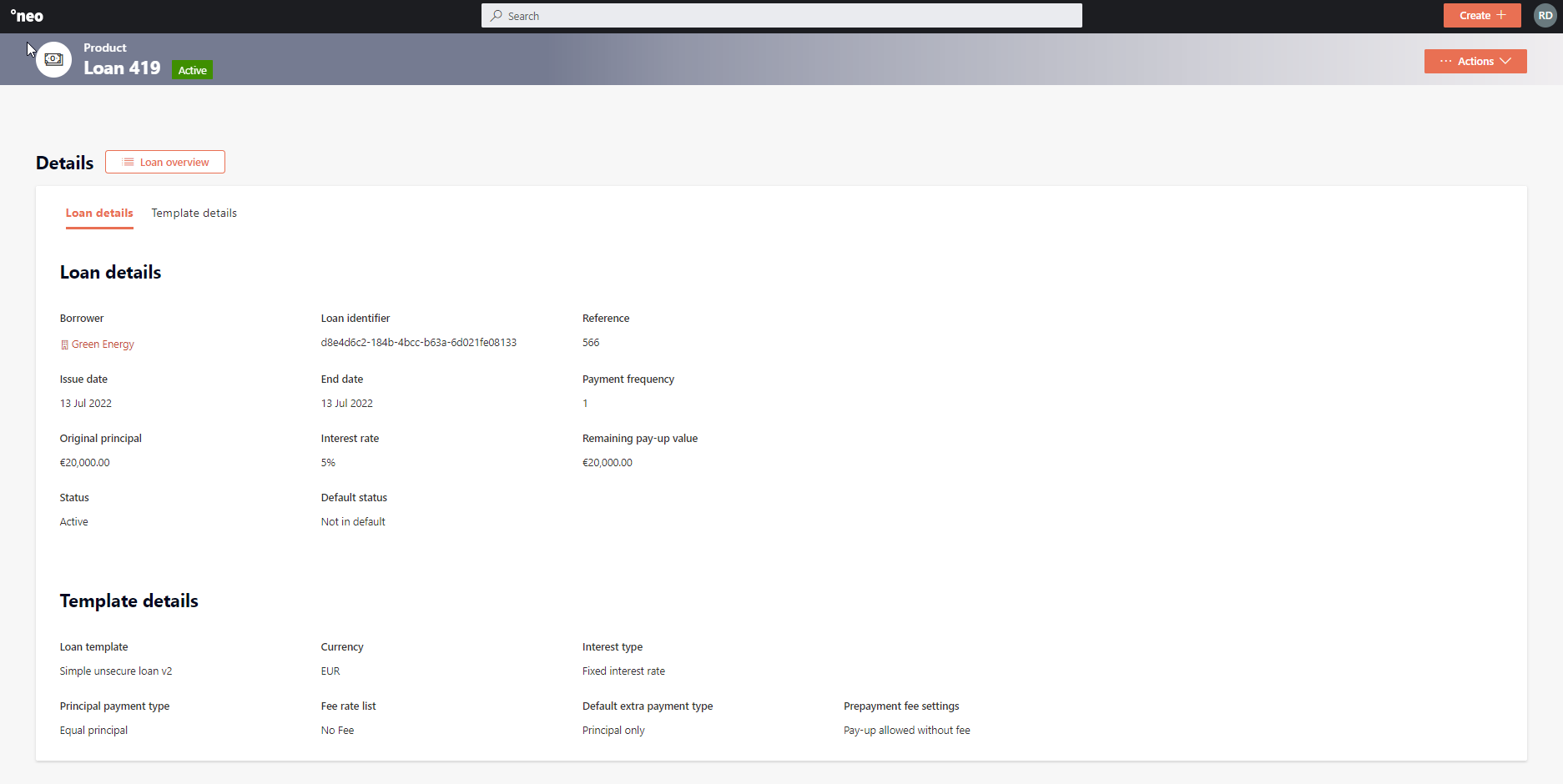

Loan summary & details

The first section of the loan overview is the loan summary & details section.

The loan summary give you the basic information on the loan, such as the borrower, loan type, original principal, interest rate, and loan duration.

By clicking the ‘Details’ button, you are able to see further information for the loan, including some of the basic information from the loan template in the Configuration Portal (e.g., principal payment type, fee settings).

Activities

The activities section displays all the Open (To do/Doing) Tasks related to this loan. This allows you or other users to complete open tasks directly while on the Loan 360° instead of having to navigate back to the dashboard. For more information on tasks see Task management .

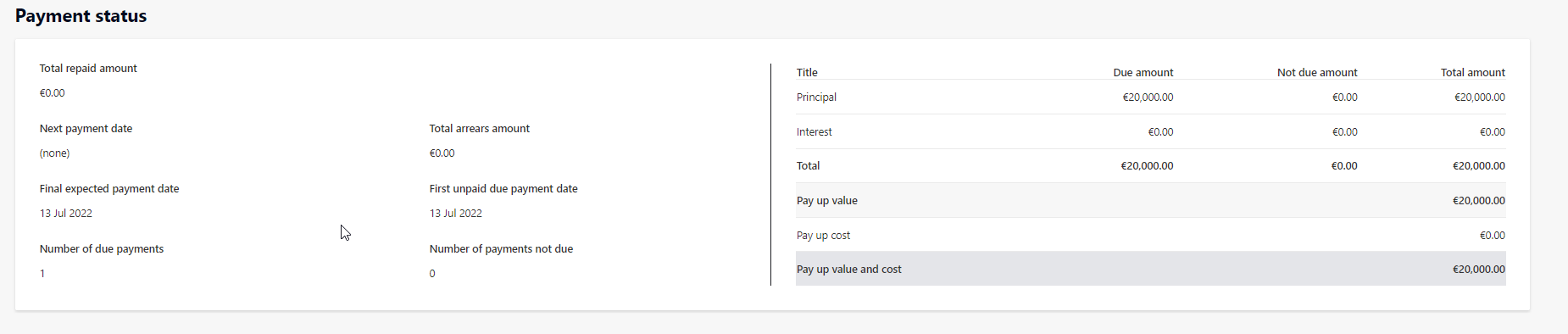

Payment status

The next section of the Loan 360° overview is the payment status. This section gives you an overview of remaining and upcoming payments, and the remaining amounts on the loan, broken down by principal and interest.

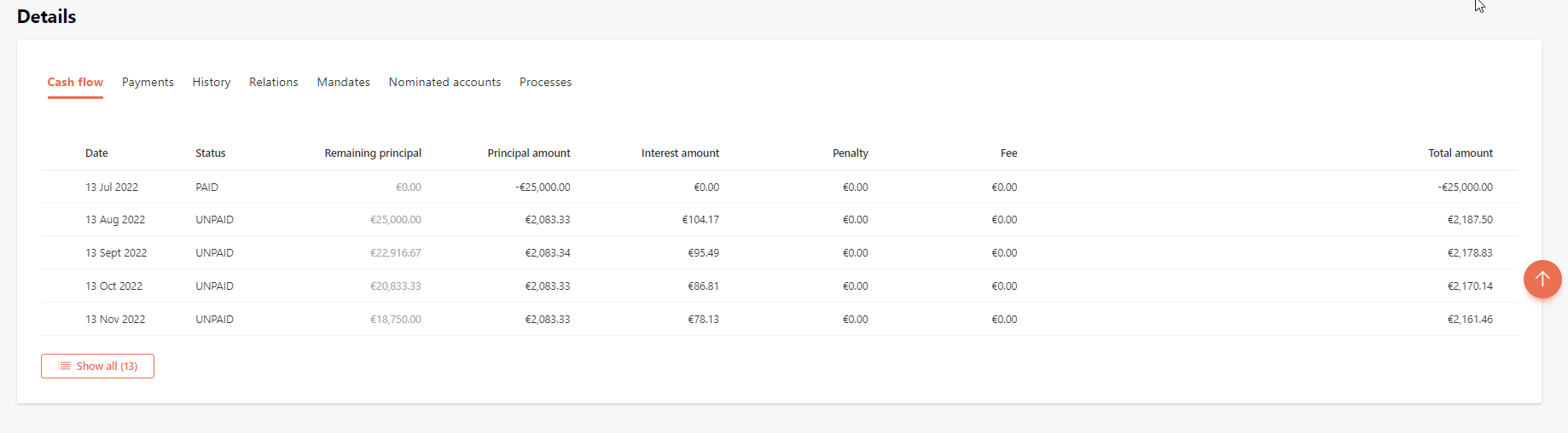

Details

The final section of the Loan 360° overview is the details section, which provides you with all the remaining information on the loan, such as cash flows, payment and loan history, relations on the loan, and any processes that were completed on the loan.

Cashflow

Cash flows , available both in table and chart format, displays all of the expected (re)payment scheme of the loan based on the initial principal, interest, fees, and payment schedule. As payments are made by the borrower, the status of each cashflow is changed from ‘Unpaid’ to ‘Paid’, and the total loan amount is adjusted accordingly.

Payments

Payments displays an overview of the payments that were made on to the loan, like external payments as a borrower pays off the loan.

History

History contains all of the historic actions that occurred on the loan, such as loan creation and approval, payments, status changes, adjustments to the term of the loan, etc..

Relations

Relations shows an overview all of the entities that have an relation to the loan, such as borrowers, guardians, power of attorney, etc.. More information on relations can be found under the Product Relations section.

Mandates

Mandates shows the active direct debit mandate that has been registered to the loan, if applicable. A direct debit mandate is a signed legal agreement that gives lenders permission to take payments from their customers bank accounts.

In the Loan 360° it is possible to add new or manage existing mandates on a loan. For more information see Direct Debit Mandates .

Nominated Accounts

Nominated accounts shows the nominated bank accounts that have been registered to the loan, if applicable. The nominated account is typically the bank account to which the loan was initially disbursed.

In the Loan 360° it is possible to create new or manage existing nominated accounts on a loan. For more information see Nominated Accounts

Processes

Processes lists all of the system related processes that were triggered on the loan, such as the create loan process. The summary list also includes some details on the status, creator, and created/completed date of the process.

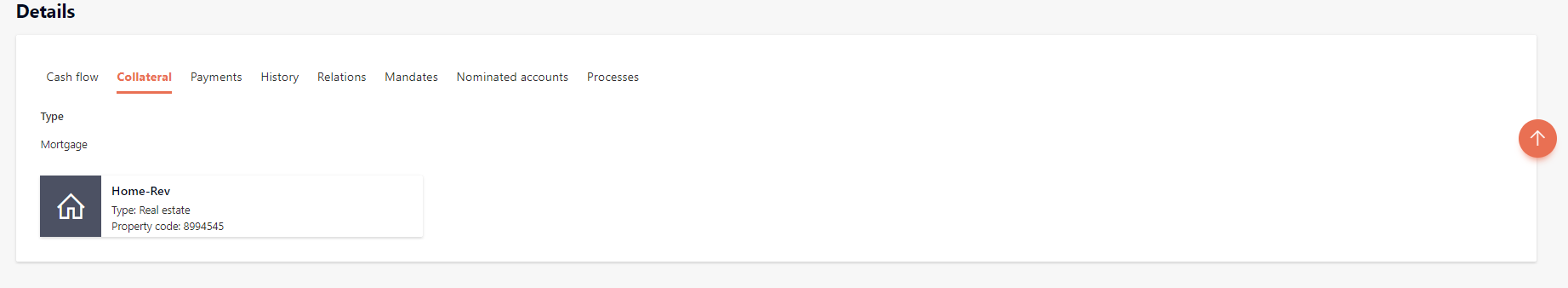

If the loan is a secured loan, there will also be an additional section to list the collateral with which the loan is secured.

Updated 20 days ago